As an internet based lender, Credibly is known for being flexible with its lending need, so corporations which has a least personal credit rating score of 550 could qualify for funding.

EarnIn only functions with employees who are compensated regularly and possess a fixed Performing locale or employer-offered e-mail deal with. The app does not do a tough or comfortable credit Check out to find out eligibility. As a substitute, borrowers ought to exhibit proof of your time worked.

There aren’t many lenders that accept applications from borrowers with credit score scores of 550. However, you will discover lenders who enable for the co-signer—someone that agrees to repay the personal loan if the key borrower are unable to—which will let you qualify for your mortgage with a score of 550.

In other information, the SBA's rule variations took impact in Could 2023 with aims of rising the volume of SBA lenders, serving to corporations qualify for funding and superior servicing compact businesses and lenders by streamlining personal loan purposes. To accomplish these aims, the SBA has produced the Local community Edge SBLC license, which enables lenders to husband or wife Along with the SBA and target getting businesses in underserved markets accepted for funding.

Curiosity will normally be quoted being an annual share price (APR), which demonstrates interest rate and another costs and fees you could have to pay for.

Improve was introduced in 2017 and provides obtainable on the internet and cellular credit and banking services. Since that time, the platform has built greater than $three billion in credit accessible to around 10 million applicants and carries on to broaden its get more info online and cellular providers.

Who Company Blueprint is sweet for: This loan may well go well with more compact and younger companies that will need usage of a generous cash flow because they develop their operations.

Savings account guideBest cost savings accountsBest high-generate financial savings accountsSavings accounts alternativesSavings calculator

Even though Common Credit history would make obtaining a personal financial loan obtainable even to People with ruined credit, it comes with a couple of tradeoffs. Initially, it expenses high APRs, properly previously mentioned by far the most competitive charges witnessed on our record.

Overview: Financial institution of The us has become the nation's biggest originators of commercial financial loans. Its large financial institution community sprawls throughout 38 U.

Our partners are unable to shell out us to guarantee favorable critiques of their merchandise or products and services. Here's a list of our partners.

The whole desire compensated on some no-credit rating-Look at financial loans is often greater than double the amount to begin with borrowed, and borrowers threat currently being trapped inside a cycle of personal debt with this kind of mortgage.

Feasible critiques applicants’ bank account transactions to determine whether or not they qualify and their loan amount, but the lender doesn’t do a tough credit rating Test. The lender reviews payments to Experian and TransUnion.

Having said that, this does not impact our evaluations. Our views are our very own. Here's an index of our companions and This is how we make money.

Kelly McGillis Then & Now!

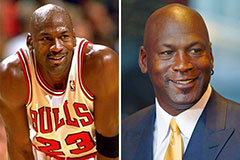

Kelly McGillis Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!